Cryptocurrency market analysis april 2025

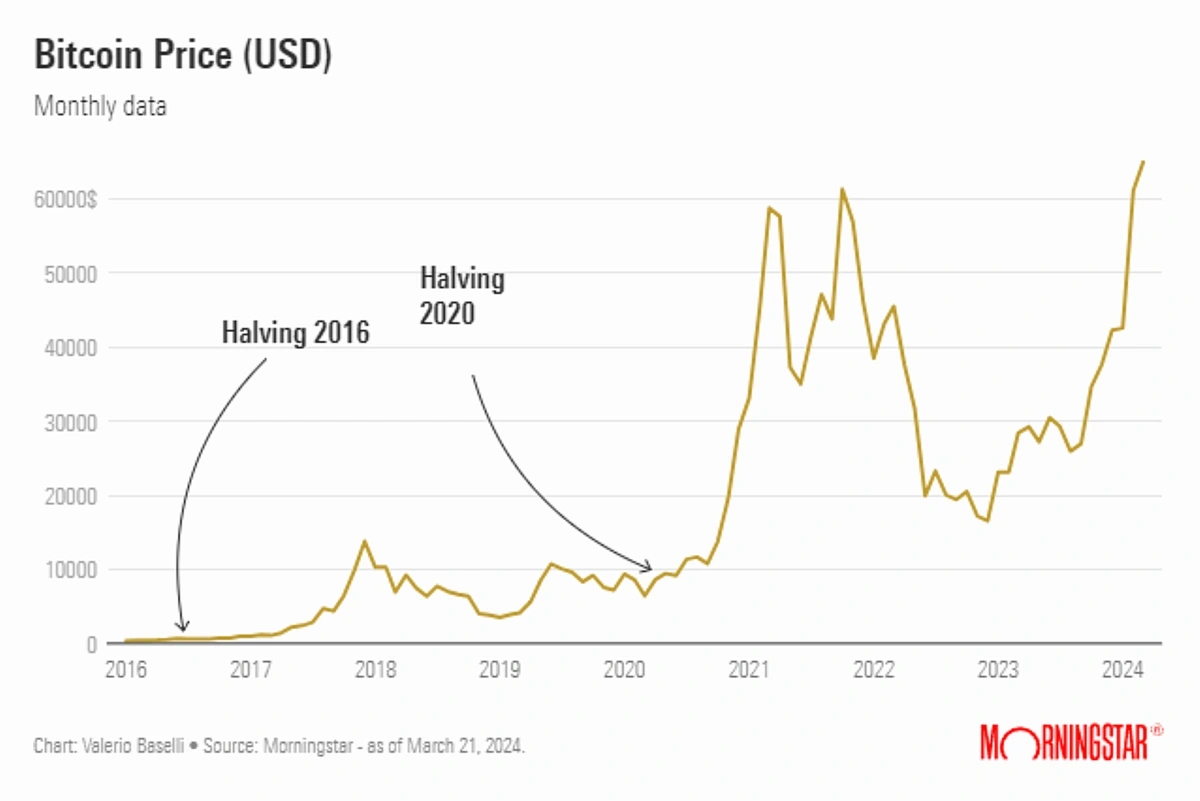

Spot crypto ETFs quickly became the fastest growing ETFs in history after their launch in early 2024, recording hundreds of billions in inflows and helping drive the price of bitcoin higher https://aheadofthespread.com/. In the US, 39% of crypto owners said they are invested in a cryptocurrency ETF, up from 37% in 2024.

Technological innovation continues to be a driving force in the cryptocurrency space. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has opened new avenues for investment and usage. Blockchain technology is being integrated into various sectors, including finance, supply chain, and healthcare, enhancing transparency and efficiency.

The success of Bitcoin ETFs has attracted diverse institutional investors, stabilizing demand and paving the way for more cryptocurrency ETFs. Meanwhile, Decentralized Finance (DeFi) is experiencing a resurgence with stronger resilience, higher lending volumes, and innovative applications, supported by evolving regulations that encourage institutional participation.

Cryptocurrency market trends march 2025

After surging in 2022 and 2023, inflationary pressures in the US dissipated in 2024 and through the first quarter of 2025. But inflation is still very much on the mind of crypto investors in the US. In 2025, 39% of US respondents said they buy and hold crypto as a way to hedge against inflation, up from 32% last year. Other countries surveyed were less concerned.

The cryptocurrency market 2025 will be shaped by a complex web of cultural, political, entertainment, and monetary trends. The rise of memecoins reflects the growing cultural relevance of cryptocurrencies, while political endorsements could lend legitimacy and spur adoption. Cryptocurrencies in the creator economy could reshape the entertainment industry, while monetary policy decisions will influence demand for cryptocurrencies as an investment asset.

The important Fibonacci level of $1.104 will play a pivotal role in determining its bullish potential. Institutional adoption and advancements in real-world asset integration could drive ONDO‘s growth, with significant upside potential if key levels are surpassed.

After surging in 2022 and 2023, inflationary pressures in the US dissipated in 2024 and through the first quarter of 2025. But inflation is still very much on the mind of crypto investors in the US. In 2025, 39% of US respondents said they buy and hold crypto as a way to hedge against inflation, up from 32% last year. Other countries surveyed were less concerned.

The cryptocurrency market 2025 will be shaped by a complex web of cultural, political, entertainment, and monetary trends. The rise of memecoins reflects the growing cultural relevance of cryptocurrencies, while political endorsements could lend legitimacy and spur adoption. Cryptocurrencies in the creator economy could reshape the entertainment industry, while monetary policy decisions will influence demand for cryptocurrencies as an investment asset.

Cryptocurrency market trends february 2025

In January, the DeFAI (Decentralized Finance + AI) sector initially outperformed other narratives, with a 90% return by mid-month. However, by the end of January, DeFAI tokens had corrected significantly, closing the month down 10% from January 1.

The midpoint suggests a strong bullish trend, driven by ongoing institutional adoption and broader acceptance. Bitcoin’s potential to exceed previous highs remains robust, contingent on sustained market momentum in $BTC.

Bitcoin will cross $150k in H1 and test or best $185k in Q4 2025. A combination of institutional, corporate, and nation-state adoption will propel Bitcoin to new heights in 2025. Throughout its existence, Bitcoin has appreciated faster than all other asset classes, particularly the S&P 500 and gold, and that trend will continue in 2025. Bitcoin will also reach 20% of Gold’s market cap. -Alex Thorn